VAT Invoice Policy

Langfarm Center supports the issuance of value-added tax (VAT) invoices directly during the online ticket booking process through the official website: www.langfarmcenter.com. Invoice issuance is conducted transparently and efficiently to ensure the rights of our customers.

1. When to Request an Invoice

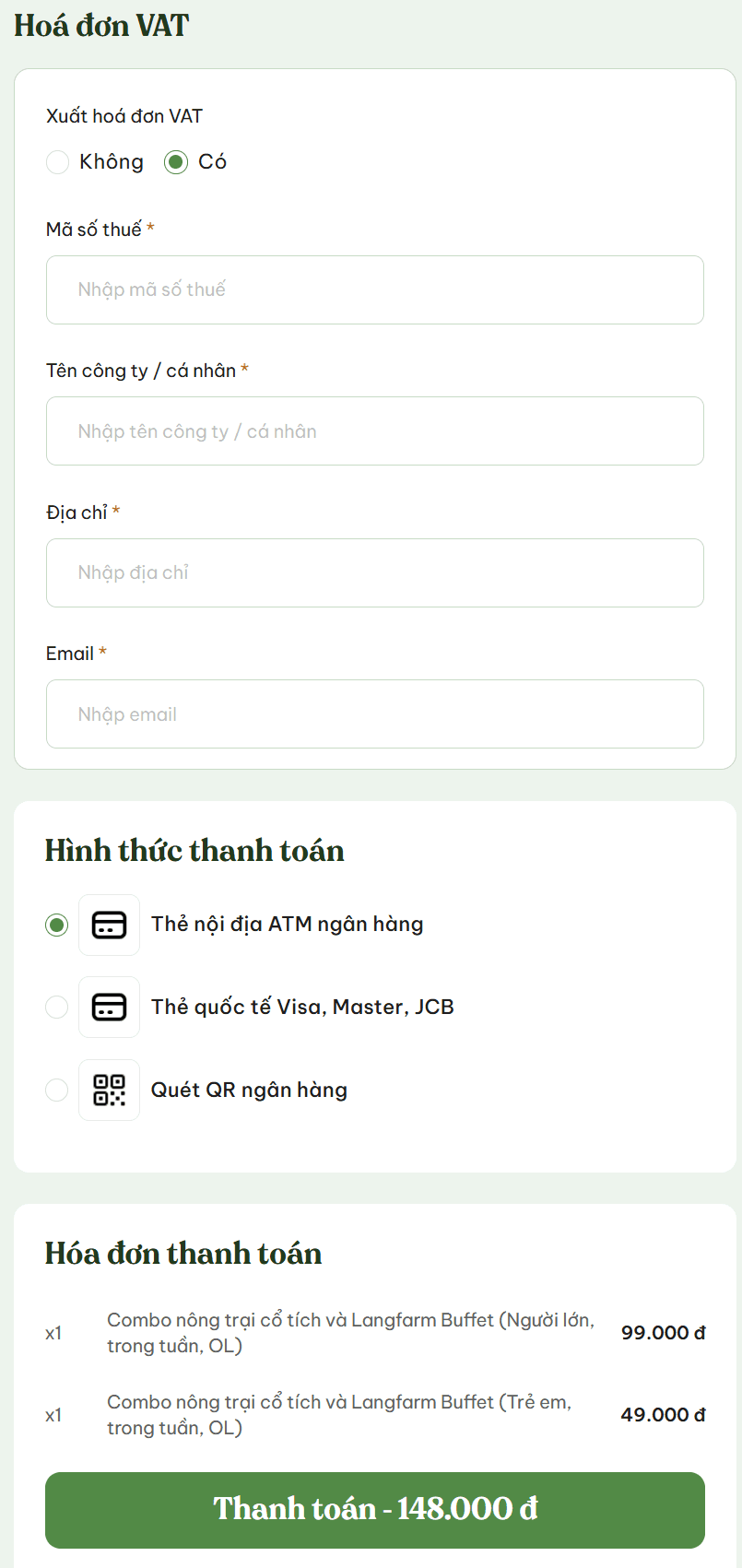

- Customers must select “Yes” in the “VAT Invoice” section during the payment step of the booking process.

- Once selected, the system will display the required fields for invoice issuance.

2. Required Information

To issue a valid VAT invoice, customers must provide all of the following:

- Tax identification number (TIN)

- Company/Individual name

- Address

- Email address to receive the invoice

⚠️ Note: All fields are mandatory. If any information is left blank or filled incorrectly, the system will not process the invoice.

Illustration:

3. Invoice Format

- Langfarm Center only issues electronic VAT invoices, in accordance with current Vietnamese regulations.

- The e-invoice will be sent to the registered email address within 03 business days after successful payment.

4. Cases Where Invoice Cannot Be Issued

- The customer did not select “Yes” and did not provide information at the time of booking.

- The provided information is invalid (e.g., incorrect tax code, missing address, etc.).

- Late invoice requests after the order has been placed will not be accepted.

5. Invoice Support

If the customer does not receive the invoice within the specified time or needs to correct any errors, please contact:

- Hotline: 0931 904 904

- Email: center@langfarm.com

- Address: 1B Hoang Van Thu Street, Ward 5, Da Lat City, Lam Dong Province

Langfarm Center is committed to transparency in revenue reporting and will fully support invoice issuance for all valid transactions.